UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to SectionPROXY STATEMENT PURSUANT TO SECTION 14(a) of the SecuritiesExchange Act of

OF THE SECURITIES EXCHANGE ACT OF 1934 (Amendment

(Amendment No. )

|  | Filed by the Registrant |   | Filed by a Party other than the Registrant |

| Check the appropriate box: | |

| Preliminary Proxy Statement |

| Confidential, for |

| Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material |

Amneal Pharmaceuticals, Inc.

(Name of Registrant as Specified Inin Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check | ||

| No fee required. | |

| Fee paid previously with preliminary materials. | |

| Fee computed on table | |

| ||

| ||

|  | |

Notice

of 20192024

Annual Meeting of Stockholders

and Proxy Statement

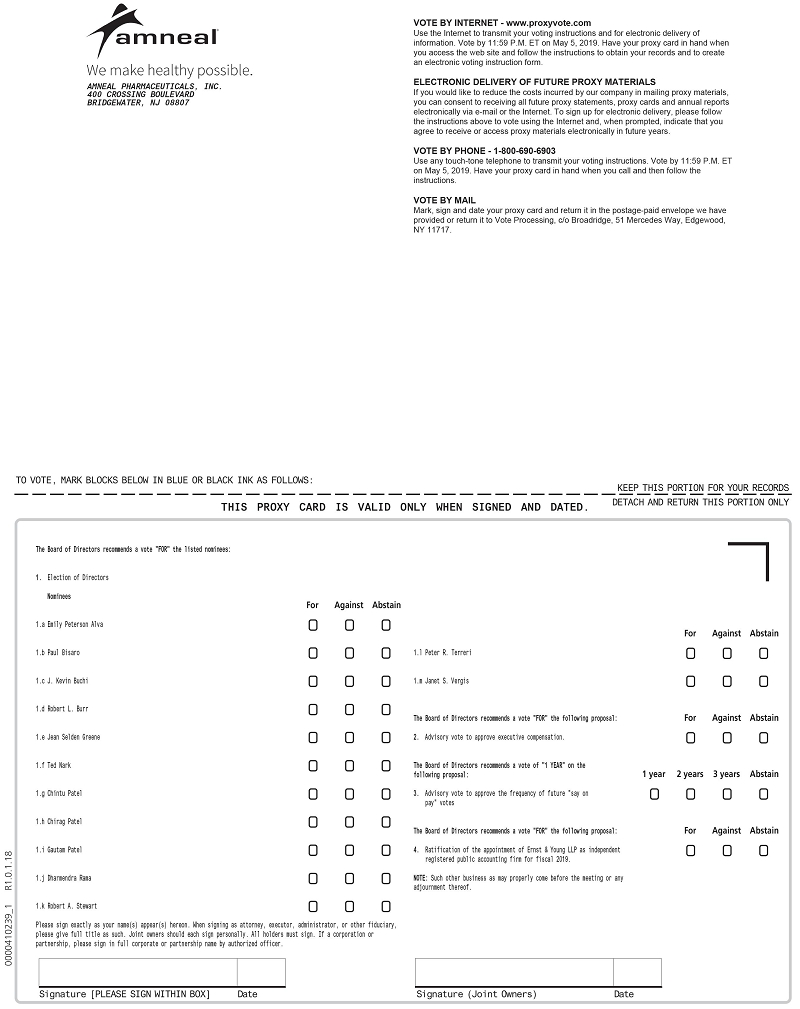

You are cordially invited to attend the Amneal Pharmaceuticals, Inc. 2019 Annual Meeting of Stockholders.

MONDAY, MAY 6, 2019

9:00 a.m., local time

The Bridgewater Marriott700 Commons WayBridgewater, NJ 08807

Items to be Voted On

You are cordially invited to attend the Amneal Pharmaceuticals, Inc. 2024 Annual Meeting of Stockholders. THURSDAY, MAY 2, 2024 9:00 a.m., Eastern Daylight Time Virtual Meeting at www.virtualshareholdermeeting.com/AMRX2024 Items to be Voted On 1. | Elect as directors the | ||

2. | Approve the compensation of our named executive officers on an advisory | ||

| basis; 3. | |||

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year | |||

4. Transact such other business as may properly come before the annual meeting or any adjournment or postponement of the meeting. Record Date You are eligible to vote if you were a stockholder of record at the close of business on March 11, 2024. A list of stockholders of record will be made available to stockholders during the meeting at www.virtualshareholdermeeting.com/AMRX2024 when you enter your 16-Digit Control Number. | Voting Your vote is important, and you are invited to attend the annual meeting. Whether or not you expect to attend the annual meeting, we encourage you to vote as soon as possible. To ensure your shares are voted, you may vote your shares in advance of the meeting over the internet, by telephone or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. Voting over the internet, by telephone or by mail will ensure your representation at the annual meeting regardless of whether you attend the meeting. Virtual Annual Meeting We are once again hosting a virtual meeting this year. The live audio webcast will be available at www.virtualshareholdermeeting.com/AMRX2024. This proxy statement and the related materials are first being distributed or made available to stockholders on or about March 22, 2024. By Order of the Board of Directors, Jason B. Daly Senior Vice President, Chief Legal Officer & Corporate Secretary Bridgewater, New Jersey |

Record Date

You are eligible to vote if you were a stockholder of record at the close of business on March 15, 2019.

Voting

Your vote is important, and you are invited to attend the annual meeting. Whether or not you expect to attend the annual meeting, we encourage you to vote as soon as possible. If you received a Notice of Internet Availability, you may vote over the internet. If you received paper copies of the proxy materials, you can also vote by telephone or mail by following the instructions on the proxy card or voting instruction card. Voting over the internet, by telephone or by mail will ensure your representation at the annual meeting regardless of whether you attend in person.

This proxy statement and the related materials are first being distributed or made available to stockholders on or about March 22, 2019.

By Order of the Board of Directors,

David A. Buchen

Corporate Secretary

Bridgewater, New Jersey

March 22, 2019

| Review your proxy statement and vote in advance of the meeting in one of | |||

|   |  |   |

| INTERNET | BY TELEPHONE | BY MAIL | |

| Visit the website on your proxy card | Call the telephone number on your proxy card | Sign, date and return your proxy card in the enclosed envelope | |

Please refer to the enclosed proxy materials or the information forwarded by your bank, broker or other holder of record to see which voting methods are available to you. Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on May 2, 2024: The notice of annual meeting, this proxy statement and our annual report on Form 10-K for the fiscal year ended December 31, | |||

| |

To

Our ValuedStockholders,

Robert Stewart

President & Chief Executive Officer

2018 was a year of significant progress for Amneal. We evolved our company with the completion of the Impax Laboratories merger – a transformative combination that has established Amneal as an industry leader with high-value generic product pipelines and a growing specialty business. Our team did an incredible job completing the Impax integration, accelerating synergy capture, launching high-value products and driving future value through the effective deployment of our capital.

As a result, even as we face significant market headwinds, we are entering 2019 a stronger, more robust Amneal with a clearly defined strategy to maximize our growth potential, stay ahead of the competition and respond to the current environment. By executing on this strategy, we are confident that we will deliver sustainable long-term growth for our shareholders and advance our mission to “make healthy possible.”

2018 Highlights

Although 2018 combined revenues were essentially flat due to industry headwinds and earlier-than-expected competition on key products, we achieved strong 2018 bottom-line results. Notably, on a full-year basis, combined adjusted EBITDA* grew by 16% to $584 million, combined adjusted diluted EPS* was $0.98 and operating cash flow was $250 million. In addition, we achieved sequential growth across all metrics as we moved through the year and ended 2018 with a strong fourth quarter.

“Our near-term priorities are focused on delivering double-digit earnings growth and solid operational cash flows”

We made significant strides in achieving our strategic priorities in 2018. We completed the Impax merger in May, and at the same time acquired Gemini Laboratories. Theintegration of Amneal with Impax and Gemini is largely complete. By the end of 2018, we completed nearly all key integration milestones and rapidly captured $60 million in synergies for 2018. We are ahead of schedule to deliver more than $200 million in synergies by the end of 2020.

| ||

ThroughOur Fellow Stockholders, Stakeholders and Colleagues,

|  | |

Chintu Patel Co-Founder, Co-Chief | Chirag Patel Co-Founder, Co-Chief |

2023 was a robust year of growth, outstanding execution, and further diversification of our focus onoperational excellence,business as we advanced our strategy to buildexpanded in new high growth areas. We are a diversified pipeline of complex, high-value generic productsand growing pharmaceutical company across Retail, Injectables, Biosimilars, Specialty, Distribution and International. Our company’s mission centers on improving access to help insulate our company from market competitionaffordable, high-quality, and pricing pressures. In 2018, Amneal led the U.S. generics industry in both approvals and launches, including 62 ANDA approvals, 10 tentative approvals and 42 new products launched. 33%innovative medicines across these areas. We are extremely proud of our new product launches were from injectable, topical or liquid products, further diversifying our portfolio of more than 200 generic products.colleagues, and the passion they bring in delivering value as We make healthy possible.

Our Specialty segment delivered2023 Highlights

Across Amneal, notable accomplishments in 2023 included:

| • | Launched 39 new Generics products as the portfolio continues to shift towards more complex, non-oral solid products; |

| • | Successfully commercialized first three biosimilars, ALYMSYS®, RELEUKO® and FYLNETRA® in first year post launch, and added two biosimilars to the pipeline; |

| • | Received approval for a number of high-value injectable products as we further expansion of our injectables portfolio; |

| • | Delivered continued growth in key Specialty products, including RYTARY® and UNITHROID®, added ONGENTYS® to expand our portfolio, and continued to advance our Specialty pipeline, including IPX203 for the treatment of Parkinson’s Disease; |

| • | Drove continued, strong double-digit growth in our durable AvKARE distribution business in the U.S.; and |

| • | Expanded our international presence as we launched three new business areas in India: Opthalmology, Diagnostics and Oncology, received approval for our first products in China and finalized numerous global partnerships for distributing our medicines. |

These achievements contributed to strong script2023 performance and financial results, highlighted by revenue growth from key marketed products Rytary®of 8% in 2023, and Unithroid®. Our R&D team was very activereflects durable growth as well, submitting 31 ANDAs – 65% for non-oral solid dosage forms – and advancing our Specialty candidate IPX203 with the dosing of first patients in our Phase 3 study.

Through thestrategic deployment of our capital,we acquired Gemini Laboratories and capitalized on creative partnership opportunities that further diversify our portfolio. This included driving additional value in generics with Jerome Stevens, Lannett and American Regent, and in biosimilars with mAbxience.

Looking Ahead: Building on a United Culture to Learn, Lead and Succeedtop line has grown consistently each year since 2019.

We have made excellent progress developing abelieve the Company’s balance sheet is strong as we successfully refinanced our debt and united employee culture at Amneal. We introducedextended maturities to 2028. In addition, we reorganized our dynamicLearn, Lead, Succeedprogram,corporate structure, which is uniting our global team around common beliefs and powerful actionsexpected to propel Amneal forward. Looking ahead, we will introduce programs in 2019 to further align rewards and recognition, as well as learning and development, with ourLearn, Lead, Succeedobjectives.

Withdrive significant cash savings for the Impax integration complete, we are shifting our focus to optimizing and strengthening our infrastructure and systems, and generating additional cost-savings that will help Amneal be more competitive and profitable in today’s market environment.

Our near-term priorities are focused on delivering double-digit earnings growth and solid operational cash flows. To do this, we will accelerate organic growth through the advancement of more than 215 products filed with the FDA or in development, drive continued operational excellence, improve our earnings potential by capturing targeted synergies, and leverage those savings to reinvest in the business.

From a long-term perspective, we are focused on strategically deploying our capital to support our growth goals. This will include expanding our generics business, where our focus is on high-value opportunities, and growing our specialty and biosimilars portfolios. At the same time, we will consider other adjacencies to insulate the company from the quarter-to-quarter fluctuations that are common to the generics industry. We will also continue pursuing creative business development opportunities to accelerate our growth.Company.

Making Healthy Possible and Accessible Through Corporate Responsibility

This isAt Amneal, we understand our important role in the healthcare sector and society at large. Our mission statement “We make healthy possible” transcends our offering of high-quality, accessible medicines to building healthy communities and a very exciting time for Amneal. We continue evolvinghealthy planet. As a company, our deep commitment to safeguarding the capabilities, strategyenvironment and talent to advance our company and provide patients with solutions that ‘make healthy possible’.serving humanity ensures we are building a resilient business well into the future.

I wantWe bring this vision to thanklife in part through our more than 6,000 employees world-wide who overdiversity and inclusion programming that nurtures the past year have relentlessly executed againstbest and brightest in global talent. We are deepening our strategy while navigating through market headwinds. Thanksportfolio of innovative products to their efforts we have made Amneal stronger for patients, customers and shareholders. We’re very optimistic about Amneal’s long-term growth potential and look forward to keeping you updated.help address unmet therapeutic needs. We are

Sincerely,

Robert A. Stewart

President and Chief Executive Officer

March 22, 2019

directing our strong R&D capabilities to create more affordable generics of complex products that help more patients access essential medicines. We routinely assess and optimize our manufacturing operations to reduce our greenhouse gas emissions. We contribute to stronger health outcomes across our local communities in the U.S., India and Ireland through aligned non-profit partnerships, corporate philanthropy efforts and employee volunteerism.

We invite you to read Amneal Pharmaceuticals’ “At a Glance,” which follows this letter and describes what we do and how we improve access to medications for patients around the world while creating long-term value for our stockholders.

We also encourage you to read the pages of this proxy statement to inform your voting decisions. We ask for your voting support and welcome you to communicate with us via the various means described in this proxy statement.

Sincerely,

Chintu Patel

Co-Founder, Co-CEO and Director

Chirag K. Patel

Co-Founder, Co-CEO, President and Director

March 22, 2024

of ContentsAMNEAL PHARMACEUTICALS’ INC. AT-A-GLANCE

WHAT DO WE DO?

We founded Amneal Pharmaceuticals, Inc. (“Amneal” or the “Company”) in 2002 to provide access to affordable medicines. Amneal is a global, vertically integrated, and diversified pharmaceuticals company. We provide over 7,700 high-quality jobs and help consumers obtain access to the medicines they need.

WHAT IS OUR STRATEGY?

We are focused on providing high-quality, affordable medicines to patients and creating value for all stakeholders. Our strategy is sharply focused, yet we believe provides the appropriate flexibility needed to navigate an unpredictable healthcare environment where cost pressures are acute. Key elements supporting our value creation strategy include:

| • | Operating large-scale, in-house best-in-class manufacturing facilities globally; | |

| • | Creating a carefully funded research and development platform to feed a large and diverse pipeline of over 160 pipeline programs to supplement our current portfolio of more than 270 marketed commercial products; | |

| • | Executing on a strategy to steadily move up the value chain to more complex and difficult-to-manufacture products that offset the steady erosion of our base Generics business and that have higher barriers to entry and more defensible revenue streams, including: | |

| • | Our move into biosimilars and sterile injectables, which typically have more durable revenue streams with institutional customers; | |

| • | Our participation in the federal healthcare sector through AvKARE, which diversifies our channel mix; | |

| • | Our Specialty segment, which benefits from a truly differentiated platform in neurology and endocrinology that helps us serve large populations with unmet needs and leverage our existing commercial infrastructure; and | |

| • | Our accelerating entry into key international markets including Europe, Asia-Pacific and other opportunistic emerging markets helping us strengthen the value of our high-value portfolio products in new ways; | |

| • | Maintaining collaborative relationships with regulators and sustaining an excellent track record within the industry, with no major observations at our sites to date; | |

| • | Steadily broadening our scientific and industry expertise through management of and partnership with adjacent life-sciences areas; | |

| • | Making strategic acquisitions in adjacent life sciences areas to enable continual and rapid pivoting and learning; and | |

| • | Responding to an evolving global regulatory environment that requires increased corporate disclosure of climate and business risks by: | |

| • | Preparing the company for disclosing its global environmental footprint, which has involved the introduction of a new carbon accounting software for tracking scope 1 and scope 2 greenhouse gas emissions in all of our global manufacturing operations; | |

| • | Increasing governance around climate and business risk through oversight of our Board of Directors and its committees, a cross-functional internal taskforce, and rigorous data management processes and approvals; and | |

| • | Reporting on our corporate impact via our annual 2023 Environmental, Social and Governance (“ESG”) report. The report was tracked against the United Nations Sustainable Development Goals and the Sustainability Accounting Standards Board Biotechnology and Pharmaceuticals Standard. | |

Further information about our Corporate Responsibility programs are available at https://www.amneal.com/about/responsibility. Please note that this website and our ESG Reports are not part of our public disclosures and are not part of our proxy solicitation materials.

WHAT DIFFERENTIATES AMNEAL PHARMACEUTICALS?

We combine the best of public company accountability, large scale vertical integration and a strong track record of agile execution with a long-term vision for the healthcare industry and Amneal’s leadership role in it. We believe this is a combination that is particularly valuable in the global, affordable medicines sector in these complex and challenging times.

| Table | |

| of Contents | |

Safe

Harbor Statement

Certain statements contained herein, regarding matters that are not historical facts, may beare forward-looking statements (as defined in the U.S. Private Securities Litigation Reform Act of 1995). Such forward-looking statements include statements regarding management’s intentions, plans, beliefs, expectations or forecasts for the future, including among other things,things: discussions of future operations; expected operating results and financial performance,performance; impact of planned acquisitions and dispositions; the Company’s strategy for growth; product development and launches, integration strategies and resulting cost reduction,development; regulatory approvals; market position and business strategy.expenditures, and other non-historical statements. Words such as “may,“plans,” “expects,” “will,” “could,“anticipates,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “assume,” “continue,”“estimates” and similar words, or the negatives thereof, are intended to identify estimates and forward-looking statements.

The reader is cautioned not to rely on these forward-looking statements. These forward-looking statements are based on current expectations of future events, including with respect to future market conditions, company performance and financial results, operational investments, business prospects, new strategies and growth initiatives, the competitive environment, and other events. If the underlying assumptions prove inaccurate or known or unknown risks or uncertainties materialize, actual results could vary materially from the expectations and projections of Amneal Pharmaceuticals, Inc. (the “Company”).Amneal. Such risks and uncertainties include, but are not limited to: the impact of global economic conditions; our ability to integrate the operations of Amneal Pharmaceuticals LLC and Impax Laboratories, LLC pursuant to the business combination completed on May 4, 2018, and our ability to realize the anticipated synergies and other benefits of the combination; our ability to successfully develop, license, acquire and commercialize new products; our ability to obtain exclusive marketing rights for our products and to introduce products on a timely basis; the competition we face in the pharmaceutical industry from brand and generic drug product companies, and the impact of that competition on our ability to set prices; our ability to manageobtain exclusive marketing rights for our growth;products; our dependence onrevenues are derived from the sales of a limited number of products, for a substantial portion of which are through a limited number of customers; the impact of a prolonged business interruption within our total revenues;supply chain; the continuing trend of consolidation of certain customer groups; our dependence on third-party suppliers and distributors for raw materials for our products and certain finished goods; legal, regulatory and legislative efforts by our brand competitors to deter competition from our generic alternatives; our dependence on information technology systems and infrastructure and the potential for cybersecurity incidents; our ability to attract, hire and retain highly skilled personnel; risks related to federal regulation of arrangements between manufacturers of branded and generic products; our reliance on certain licenses to proprietary technologies from time to time; the significant amount of resources we expend on research and development; the risk of product liability and other claims brought against us by consumers and other third parties; risks related to changes in the regulatory environment, including United StatesU.S. federal and state laws related to healthcare fraud abuse and health information privacy and security and changes in such laws; changes to FDAFood and Drug Administration product approval requirements; risks related to federal regulation of arrangements between manufacturers of branded and generic products; the impact of healthcare reform and changes in coverage and reimbursement levels by governmental authorities and other third-party payers; the continuing trend of consolidation of certain customer groups; our reliance on certain licenses to proprietary technologies from time to time; our dependence on third party suppliers and distributors for raw materials for our products and certain finished goods; our dependence on third partythird-party agreements for a portion of our product offerings; our ability to make acquisitions of or investments in complementary businesses and products on advantageous terms; legal, regulatory and legislative efforts by our brand competitors to deter competition from our generic alternatives; the significant amount of resources we expend on research and development; our substantial amount of indebtedness and our ability to generate sufficient cash to service our indebtedness in the future, and the impact of interest rate fluctuations on such indebtedness; our potential expansion into additional international markets subjecting us to increased regulatory, economic, social and political uncertainties, including recent events affecting the financial services industry; our ability to identify, make and integrate acquisitions or investments in complementary businesses and products on advantageous terms; the impact of global economic, political or other catastrophic events; our obligations under a tax receivable agreement may be significant; and the high concentration of ownership of our Classclass A Common Stockcommon stock and the fact that we are controlled by a group of stockholders. A further listthe Amneal Group. The forward-looking statements contained herein are also subject generally to other risks and descriptions of these risks, uncertainties that are described from time to time in our filings with the Securities and other factors can be foundExchange Commission (the “SEC”), including under Item 1A, “Risk Factors” in the Company’sour most recently filedrecent Annual Report on Form 10-K and in the Company’sour subsequent filings with the Securitiesreports on Forms 10-Q and Exchange Commission. Copies of these filings8-K. Investors are available online at www.sec.gov, www.amneal.com orcautioned not to place undue reliance on request from the Company.

Forward-lookingany such forward-looking statements, included hereinwhich speak only as of the date hereofthey are made, and we undertake no obligation to revise or update such statements to reflect the occurrence of events or circumstances after the date hereof.

Business Combination and Corporate Structure

Amneal Pharmaceuticals, Inc. (the “Company”)The Company is a Delaware corporation that was formed on October 4, 2017, for the purpose of facilitating the combination (the “Combination”holding company, whose principal assets are common units (“Amneal Common Units”) of Amneal Pharmaceuticals LLC (“Amneal”Amneal LLC”), a Delaware limited liability company, and. In 2018, Amneal LLC completed the acquisition of Impax Laboratories, Inc. (“Impax”), a Delaware corporation. Prior to the Combination, Amneal was a privately held limited liabilitygeneric and specialty pharmaceutical company and Impax was a publicly held corporation. As a result of the Combination, Impax became a Delaware limited liability company wholly owned by Amneal, and Amneal became the operating company for the combined business. (the “Combination”).

The group, together with their affiliates and certain assignees, who owned Amneal prior to the CombinationLLC when it was a private company (the “Amneal Group”) continues to hold approximately 57%held 50.1% of the equity interests in Amneal Common Units and the Company holdsheld the remaining 43%49.9% as of the equity interests in Amneal. The Amneal Group also holds approximately 57% of the common stock ofDecember 31, 2022. On November 7, 2023, we implemented a plan pursuant to which the Company and Amneal LLC reorganized and we simplified our corporate structure by eliminating our umbrella partnership-C-corporation structure and converting to a more traditional structure whereby all stockholders hold their voting and economic interests directly through its collective ownership of all of the issued and outstanding shares of class B common stock. Althoughpublic company (the “Reorganization”). Effective with the Reorganization, the Company directly or indirectly holds a minority economic interest in Amneal, as the managing member of Amneal we conduct and exercise full control over all activities of Amneal. Three members100% of the Amneal Group, Chirag Patel, Chintu PatelCommon Units and Gautam Patel, are membersthe Company remains Amneal LLC’s sole managing member, having the sole voting power to make all of Amneal LLC’s business decisions and control its management. Shortly after we effected the Reorganization, at market open on December 27, 2023, we transferred the listing of our Board of Directors and have been nominated for election atClass A common stock to the annual meeting of stockholders.Nasdaq Stock Market LLC (“Nasdaq”).

In connection with the Combination, we entered into a stockholders agreement (the “Stockholders Agreement”) with the Amneal Group, which was amended and restated in August 2019 and again in November 2023 as part of the Reorganization (the “Stockholders Agreement”), that sets forth, among other things, certain rights and obligations of the Company and the Amneal Group with respect to the corporate governance of the Company.

The Stockholders Agreement provides that, until the Amneal Group owns less than 10% of the outstanding shares of the Company’s common stock, the Board of Directors of the Company (the “Board”) will consist of no more than 13 members, subject to increase if TPG Group Holdings’ (“TPG”) exercises its right to designate a director for appointment to the Company’s Board (as described below).members.

Following the closingAs of the Combination, pursuant to the Stockholders Agreement,date hereof, the Board washas fixed its size at 11, composed as follows:

| • | Amneal Group Directors. |

| • | Non-Amneal Group Directors.Five directors were designated |

For so longPursuant to, and effective as of, the amendment to the Stockholders Agreement in August 2019, the Amneal Group continues to beneficially own more than 50% ofrepresentative who appoints the outstanding sharesAmneal Group Directors will not be (i) an employee of the Company directors designatedor (ii) an individual controlled, directly or indirectly, by employees of the Company, a Company subsidiary, or any person controlled by the Company. This change was made in connection with the appointment of Chirag Patel and Chintu Patel as co-Chief Executive Officers in order to preserve the independence of those Amneal Group will have the rightDirectors who are intended to designate the Co-Chairmen of the Board, and the Non-Amneal Group directors will have the right to designate the Lead Independent Director of the Board.

TPG, which holds all of our issued and outstanding class B-1 common stock by virtue of its investment in the Company, has the right, subject to certain ownership thresholds and other limitations, to designate a director for appointment to the Company’s Board (which right TPG has not exercised) or to designate an observer to the Board.

If TPG exercises its right to designate a director, its designee will be appointed to the Board subject to the approval of the Nominating and Corporate Governance Committee of the Board. Upon such appointment, subject to certain limitations, the Amneal Group will have the right to designate an additional director to the Board. The addition of such TPG and Amneal Group designees would cause the size of the Board to increase to 15 members. Additionally, at any time after the earlier of May 4, 2019 or the date of appointment of a director designated by TPG, we will have the right under the Amneal charter to convert all of the outstanding shares of Class B-1 Common Stock, all of which are currently held by TPG, into shares of Class A Common Stock. If TPG exercises its right to designate a director, the TPG designee, and any corresponding additional Amneal Group designee, would be appointed to the Board after the conclusion of the 2019 annual meeting and serve for a term ending on the date of our 2020 annual meeting of stockholders or until his or her successor shall be elected and qualify or until his or her earlier death, resignation or removal.

There are currently two observers to the Board, one has been designated by the Board of Directors and one has been designated by TPG.independent.

For so long as the Amneal Group continues to beneficially own more than 50% of the outstanding shares of the Company, the Amneal Group Directors will have the right to designate the Chairman or Co-Chairmen of the Board, and the Non-Amneal Group Directors will have the right to designate a lead Independent Director of the Board (as applicable).

TPG Group Holdings has the right, subject to certain ownership thresholds and other requirements, to designate a director for appointment to the Company’s Board (which right TPG currently has not exercised) or to designate an observer to the Board.

There are currently two observers to the Board, one of whom has been designated by the Board of Directors and one of whom has been designated by TPG Group Holdings.

For so long as the Amneal Group continues to beneficially own more than 50% of the outstanding shares of the Company, the Amneal

| www.amneal.com | AMNEAL PHARMACEUTICALS, INC. | 2024Proxy Statement | 10 | ||

Group will have the right to designate for nomination the lowest number of designees that constitute a majority of the total number of directors comprising the Board. The Company will cause such nominee(s) to be included in any slate of nominees recommended by the Board to the stockholders of the Company for election. Seventy-five percent (75%) of the directors serving on the Nominating and Corporate Governance Committee will be required to approve (i) a decision not to nominate any of the initial directors of the Company as of the closing of the Combination for re-election to the Board at either of the first two annual meetings of stockholders of the Company following the completion of the Combination and (ii) until the third annual meeting of stockholders of the Company following the completion of the Combination, any change to the individuals serving as Chairman or Co-Chairmen of the Company’s Board.

If the Amneal Group beneficially owns 50% or less but more than 10% of the outstanding shares of the Company, the Amneal Group will have the right to designate a number of directors proportionate to the beneficial ownership of outstanding shares of the Company held by the Amneal Group (rounded up to the nearest whole number); provided, however, that such rounding shall not result in the Amneal Group having the right to designate a majority of the total number of directors comprising the Board when the Amneal Group beneficially owns 50% or less of the outstanding shares of the Company’s common stock.

With respect to the Amneal Group Directors, until the date on which the Amneal Group ceases to beneficially own at least 10% of the outstanding shares of the Company (the “Trigger Date”), any vacancy will be filled by the Board with a director designated by the Amneal Group, except when such vacancy is created when the number of the Amneal Group Directors then serving on the Board is in excess of the number of Amneal Group designees the Amneal Group has the right to designate under the Company’s Bylaws and the Stockholders Agreement.

With respect to the Non-Amneal Group Directors, the Nominating and Corporate Governance Committee will recommend to the Company’s Board directors to fill any vacancy (other than the CEO of the Company) with a person who satisfies all the qualifications of a Company Independent Director (as defined in the Stockholders Agreement), subject to the prior written consent of the Conflicts Committee.

The Stockholders Agreement provides that the Company’s Board shall initially have the following committees: (i) Audit Committee, (ii) Nominating and Corporate Governance Committee, (iii) Compensation Committee, and (iv) Conflicts Committee, and (v) Integration Committee. The formation of, composition of, and amendment to the charter of any other committee requires the approval of 75% of the directors on the Company’s Board.

Until the Trigger Date, each committee of the Company’s Board (other than the Conflicts Committee) will include at least one director designated by the Amneal Group, subject to the applicable NYSENasdaq rules and requirements. If at any time, any committee (other than the Conflicts Committee) does not have at least one such Amneal Group-designated director, the Amneal Group will be entitled to designate a director to have observer rights with respect to such committee. The formation and composition of any committee not specified above requires the approval of 75% of the Company’s Board.

Until the Trigger Date, the Amneal Group must cause its shares to be present for quorum purposes at any stockholders meeting, vote in favor of all director nominees recommended by the Company’s Board, and not vote in favor of the removal of any Non-Amneal Group Director, unless such removal is recommended by the Nominating and Corporate Governance Committee.

For so long as the Amneal Group beneficially owns more than 25% of the outstanding shares of the Company, the Company will not take the following actions without obtaining prior consent of the Amneal Group:

| • | amend, modify, or repeal any provision of the Company’s Certificate of Incorporation or Bylaws in a manner that adversely impacts any Amneal Group member; |

| • | effect any change in the authorized number of directors, except pursuant to the Stockholders Agreement; |

| • | create or reclassify any new or existing class or series of capital stock to grant rights, preferences, or privileges with respect to voting, liquidation, redemption, conversion or dividends that are senior to or on parity with those of the shares held by the Amneal Group; or |

| • | consummate any transaction as a result of which (a) more than 50% of the outstanding shares of the Company will be beneficially owned by any persons other than Amneal Group members and (b) any Amneal Group member receives an amount or form of consideration different from that which is granted to other holders of the Company’s shares. |

As previously disclosed and referenced above, in light of the substantial investment of the Amneal Group prior to the Combination, the Company continues to have certain legacy obligations and corporate governance features that were adopted in connection with the Combination. In particular, the Bylaws that we adopted following the Combination contained a provision requiring the vote of not less than two-thirds of the voting power of the issued and outstanding shares entitled to vote at a duly called and convened annual or special meeting of stockholders in order to amend certain limited Bylaws provisions, including provisions related to stockholder meetings and proposals as well as to the number, term and removal of and nominating

| AMNEALPHARMACEUTICALS, INC. | | |||

process for directors. Given the consent rights afforded to the Amneal Group described above pursuant to the Stockholders Agreement, coupled with the continued significant ownership stake of the Company by the Amneal Group, as exemplified by the Company’s designation as a “controlled company” as further discussed below, we expect that this provision will remain in place for the foreseeable future unless otherwise determined by the Amneal Group.

We are committed to conducting every aspect of our business in an ethical, open and honest manner and in full compliance with the law, both in letter and in spirit. Our Code of Business Conduct applies to all of our employees, officers and directors and lays out guidelines for our employees, officers and directors to follow as they conduct business on behalf of our Company. We have also adopted Corporate Governance Guidelines, which, together with our Certificate of Incorporation, Bylaws and Board committee charters, form the framework for the corporate governance of the Company. In addition, the Stockholders Agreement between the Company and the Amneal Group and the limited liability company agreement of Amneal LLC set forth a number of corporate governance requirements with respect to the Company.

The full text of the Code of Business Conduct as well as our Corporate Governance Guidelines, Audit Committee Charter, Compensation Committee Charter, Nominating and Corporate Governance Committee Charter Integration Committee Charter and Conflicts Committee Charter are available at the investors section of our web site, http://investors.amneal.com. We intend to disclosesatisfy our disclosure obligations, if any, with respect to any amendment to, or waiver from, a provision of the Code of Business Conduct that applies to our directors or executive officers, including our principal executive officer,officers, principal financial officer or principal accounting officer, in the investors section of our web site. Stockholders may request free printed copies of the Code of Business Conduct, Corporate Governance Guidelines and the Board committee charters by writing to: Amneal Pharmaceuticals, Inc., Attention: Corporate Secretary, 400 Crossing Boulevard, Bridgewater, NJ 08807 or corporatesecretary@amneal.com.

The Amneal Group holds a majority of the voting power of our common stock and, pursuant to provisions set forth in our Certificate of Incorporation, Bylaws and the Stockholders Agreement, the Amneal Group has the ability to designate and elect a majority of our directors.stock. As a result, we are a “controlled company” as defined by NYSE listingNasdaq rules and mayhave the option to elect to avail ourselves of exemptions relatingfrom certain Nasdaq requirements. Despite our status as a controlled company, however, we have chosen to govern ourselves without using these exemptions, which we believe sets the Board and certain Board committees. Despiteright tone with respect to our approach to corporate governance. Generally speaking, under Nasdaq rules, a controlled company is exempt from the availabilityrequirements of such exemptions, our Board currently has(a) a majority of the board of directors consisting of independent directors; (b) independent director oversight of director nominations; and (c) a compensation committee composed entirely of independent directors, with a written charter addressing specified matters. Although we currently do not avail ourselves of any of these exemptions in the interest of corporate governance best practices, if we were to take advantage of any of them, our stockholders would not have the same protections afforded to stockholders of companies that are subject to all of the Nasdaq requirements. We believe that the Amneal Group’s control and its long-term stewardship have provided a Nominatingstrategic advantage to our Company. For example, the alignment between our co-CEOs and Corporate Governance Committee composed solely of independent directors. As permitted by NYSE listing rulesthe Amneal Group as our largest stockholder provides management the flexibility to efficiently pivot as needed to address short-term matters while also supporting transformational changes necessary for “controlled companies,” the Compensation Committee is not composed solely of independent directors.Company’s long-term success. In addition, the Amneal Group’s values have played an important role in our unique work culture that celebrates inclusion, diversity, and equity, which we believe has helped us to attract and retain top talent.

In accordance with the General Corporation Law of the State of Delaware and our Certificate of Incorporation and our Bylaws, our business, property and affairs are managed under the direction of the Board of Directors. Although our non-employee directors are not involved in our day-to-day operating details, they are kept informed of our business through written reports and documents provided to them regularly, as well as by operating, financial and other reports presented by our officers at meetings of the Board of Directors and committees of the Board of Directors.

Our Board of Directors is led by an Executive Chairman, who is also an officer of the Company, two Co-Chairmen and a Lead Independent Director. Because none of the Executive Chairman and Co-Chairmen are independent directors, the independent directors of the Board have elected a lead director, who is independent.Chairman. The Lead Independent Director’sChairman’s responsibilities include, but are not limited to, presiding over all meetings of the Board at which the Executive Chairman and Co-Chairmenmembers of management are not present, including any executive sessions of independent directors, reviewing Board meeting schedules and agendas and acting as a liaison between the independent directors Chiefand the Co-Chief Executive Officer,Officers. Our Co-Chief Executive Chairman and Co-Chairmen. Our Chief Executive Officer doesOfficers do not hold a leadership positionpositions on the Board, but our Corporate Governance Guidelines do not prohibit himthem from doing so.so, as the Board retains the discretion to modify its leadership structure in the future as it deems appropriate. The Board has determined that its leadership structure currently is in the best interests of the Company and our stockholders because it allows our ChiefCo-Chief Executive OfficerOfficers to focus on our day-to-day business and our Executive Chairman to manage thefocus on managing Board operations of the Boardand effectiveness and other corporate governance matters, while providing independent Board leadership through the Lead Independent Director.leadership.

| www.amneal.com | AMNEALPHARMACEUTICALS, INC. | | |||

From the inception of the Company in May 2018 through the end ofIn the fiscal year ended December 31, 2018 (fiscal 2018)2023 (“fiscal 2023”), the Board of Directors held 3five meetings. Each of the directors attended at least 75% of the aggregate of all meetings held by the Board of Directors and each committee of the Board of Directors on which he or she served during fiscal 2018,2023, in each case held during the period for which he or she was a director and committee member. Our non-employee directors meet regularly (at least quarterly) in executive session of the Board without employee directors or employees present, and our independent directors meet in executive session at least twice annually. The Lead Independent DirectorChairman presides over executive sessions of the non-employee directors and the independent directors. Mr. Chirag Patel and Mr. Chintu Patel do not attend executive sessions of non-employee directors.

Stockholders, employees and all other interested parties may communicate with a member or members or a committee of the Board of Directors by addressing their correspondence to the Board member or members or committee c/o Corporate Secretary, Amneal Pharmaceuticals, Inc., 400 Crossing Boulevard, Bridgewater, NJ 08807 or by email to corporatesecretary@amneal.com.corporatesecretary@amneal. com. Our corporate secretary will review the correspondence and will determine, in his good faith judgment, which stockholder communications will be relayed to the Board of Directors, any committee or any director. Our corporate secretary has the authority to discard or disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications. Subject to the foregoing, mail addressed to “Board of Directors” or “non-management directors” will be forwarded to the Lead Independent Director.Chairman.

Recognizing that director attendance at our annual meetings can provide our stockholders with a valuable opportunity to communicate with Board members about issues affecting our Company, we encourage our directors to attend each annual meeting of stockholders. We anticipate that all directors will attend the 2019The 2023 annual meeting which is our first annual meetingwas attended by all eleven of stockholders following the Combination.directors holding office at the time.

In making independence determinations, the Board of Directors observes all criteria for independence established by the U.S. Securities and Exchange Commission (“SEC”), the NYSE,SEC, Nasdaq, other governing laws and regulations, and the Stockholders Agreement. The BoardAgreement, and considers all relevant facts and circumstances in making an independence determination.circumstances. In accordance with our Corporate Governance Guidelines, to be considered independent:

| • | the director must meet the bright-line independence tests under |

| • | the Board must affirmatively determine that the director otherwise has no |

The Board of Directors, through its nominating and governance committee,Conflicts Committee, annually reviews all relevant business relationships any director may have with our Company. As a result of its annual review, the Board has affirmatively determined that each of the following directors meets the independence tests under the listing standards of the New York Stock Exchange,Nasdaq rules, none of the following directorsthem has a material relationship with the Company other than their service as directors and, as a result, such directors are independent: Robert L. Burr,Paul Meister, Deb Autor, J. Kevin Buchi, Peter R. Terreri, Janet S. Vergis,Jeff George, John Kiely, Ted Nark, Emily Peterson Alva Jean Selden Greene and Dharmendra Rama.Shlomo Yanai. Accordingly, even though we are a “controlled company” and therefore exempt from certain board independence requirements under the Nasdaq rules, we nonetheless have a majority of independent directors on our Board, and each Board committee is comprised entirely of independent directors.

In making the foregoing independence determination, the Board of Directors considered the following relationships:

The Board considered each of these relationshipsrelationship in light of the Company’s independence standards and determined that neither relationship constitutesit does not constitute a material relationship with the Company.Company:

Emily Peterson Alva’s spouse was employed by Avtar Investments, LLC (“Avtar”), a financial advisory firm that manages investments for Chirag Patel and Chintu Patel, each a member of the Amneal Group and Co-CEOs of the Company. Ms. Alva’s spouse is no longer affiliated with Avtar.

In addition to the director independence standards described above, the Stockholders Agreement imposes additional independence requirements that apply in certain circumstances. The Stockholders Agreement defines a “Company Independent Director” as a director who:

| • | meets the independence standards under the rules of |

| • | is a non-Amneal Group Director; |

| • | is not a current or former member of the Board of Directors of any Amneal Group member or its affiliates or officer or employee of any Amneal Group member or its affiliates; |

| • | does not have and has not had any other material relationship with the Company or its affiliates; and |

| • | is designated |

| AMNEAL PHARMACEUTICALS, INC. | 2024Proxy Statement | 13 | ||

The Board of Directors has fivefour standing committees: an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, an Integration Committee and a Conflicts Committee.

The following table sets forth the current members of each committee and the number of meetings held during fiscal 20182023 for each of the Board’s committees, as well as each director’s status as either independent or not independent and either an Amneal Group Director or Non-Amneal Group Director.

| Independent | Amneal Group Director | Non-Amneal Group Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Integration Committee | Conflicts Committee | |||||||||

| Emily Peterson Alva |  |  |  | |||||||||||||

| Paul Bisaro |  |  | ||||||||||||||

| J. Kevin Buchi |  |  |  |  |  | |||||||||||

| Robert L. Burr |  |  |  | Chair |  | |||||||||||

| Jean Selden Greene |  |  |  | |||||||||||||

| Ted Nark |  |  | Chair | |||||||||||||

| Chintu Patel |  | Chair | ||||||||||||||

| Chirag Patel |  |  | ||||||||||||||

| Gautam Patel |  |  | ||||||||||||||

| Dharmendra Rama |  |  |  | |||||||||||||

| Robert A. Stewart |  |  | ||||||||||||||

| Peter R. Terreri |  |  | Chair |  | ||||||||||||

| Janet S. Vergis |  |  |  | Chair | ||||||||||||

| Number of Meetings | 5 | 3 | 3 | 4 | 3 |

| Independent | Amneal Group Director | Non-Amneal Group Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | Conflicts Committee | ||||||||

| Emily Peterson Alva |  |  |  | |||||||||||

| Deb Autor |  |  |  |  | ||||||||||

| J. Kevin Buchi |  |  |  |  | Chair | |||||||||

| Jeff George |  |  |  |  |  | |||||||||

| John Kiely |  |  | Chair |  |  | |||||||||

| Paul Meister |  |  |  | Chair | ||||||||||

| Ted Nark |  |  | Chair |  | ||||||||||

| Chintu Patel |  | |||||||||||||

| Chirag Patel |  | |||||||||||||

| Gautam Patel |  | |||||||||||||

| Shlomo Yanai |  |  |  |  | ||||||||||

| # of Meetings in 2023 | 5 | 5 | 4 | 15 |

The principal duties and responsibilities of our Audit Committee are to assist the Board in its oversight of:

| • | the quality and integrity of the Company’s financial statements; |

| • | the Company’s compliance with legal and regulatory requirements; |

| • | the implementation of the Company’s enterprise risk management program and policies with respect to risk assessment and risk management, including cyber risks and information security; |

| • | the independent auditor’s qualifications, performance and independence; and |

| • | the performance of the Company’s internal audit |

The Audit Committee has the power to investigate any matter brought to its attention within the scope of its duties. It also has the authority to retain counsel and advisors to fulfill its responsibilities and duties. Each director who serves on the Audit Committee is independent under the listing standards of the NYSENasdaq rules and as that term is used in Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended. The Board of Directors has determined that Peter Terrerieach member of the Audit Committee meets the financial sophistication requirements of Nasdaq. Further, the Board of Directors has determined that John Kiely qualifies as an Audit Committee financial expert as that term is defined by applicable SEC regulations and has designated Peter TerreriMr. Kiely as the Audit Committee’s financial expert.

The Audit Committee operates under a written charter adopted by the Board of Directors. A copy of the charter is available at the investor relations section of our website at https://investors.amneal.com/investors. amneal.com/corporate-governance/policies. The report of the Audit Committee begins on page 5964 of this proxy statement.

The principal duties and responsibilities of the Compensation Committee are as follows:

| • | review and oversee the Company’s overall compensation philosophy and oversee the development and implementation of compensation programs aligned with the Company’s business strategy; |

| • | review and make recommendations to the Board in overseeing the compensation of the Company’s directors and Co-Chief Executive Officers and review and approve the compensation of the Company’s other executive officers; |

| • | review and approve or make recommendations to the Board regarding the Company’s annual cash incentive program and equity-based plan and arrangements; |

| www.amneal.com | AMNEALPHARMACEUTICALS, INC. | | |||

| • | review and discuss with management the Company’s “Compensation Discussion and Analysis” (“CD&A”) and recommend whether such analysis should be included in the Proxy Statement filed with the SEC; |

| • | produce an annual report on executive compensation for inclusion in the Company’s Proxy Statement; |

| • | review and discuss the results of the stockholder advisory vote on “say-on-pay”, if any, and general market reactions to executive compensation regard to the Company’s named executive officers; |

| • | review and approve any stock ownership guidelines for directors and executive officers of the Company and monitor complaiance therewith; |

| • | review and approve any “clawback” policy to be adopted by the Company to recoup compensation paid to employees, if and as the committee determines to be necessary or appropriate, or as required by applicable law or Nasdaq requirements, and monitor compliance therewith; |

| • | oversee the Company’s policies and practices with respect to managing compensation-related risks; |

| • | oversee and approve the management continuity process; and otherwise comply with the committee’s responsibilities and duties as set forth in its charter. |

Compensation Committee

The principal duties and responsibilities of the Compensation Committee are to oversee the discharge of the responsibilities of the Board relating to compensation of the Company’s executive officers and directors.

Three of the four directorsEach director who serveserves on the Compensation Committee areis independent under the listing standards of the NYSENasdaq rules and applicable SEC regulations with respect to Compensation Committees. In addition to satisfying all other applicable independence requirements, all members of the Compensation Committee qualify as “non-employee directors” for purposes of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Compensation Committee operates under a written charter adopted by the Board of Directors, a copy of which is available at the investor relations section of our website at https://investors.amneal.com/corporate-governance/policies. The report of the Compensation Committee is on page 3640 of this proxy statement.

Pursuant to the Stockholders Agreement, the Amneal Group has the right to nominate two of the four directors serving on the Compensation Committee for so long as the Amneal Group beneficially owns more than 50% of the outstanding shares of the Company. The remaining directors are designated by a majority of the Company Independent Directors of the Company’s Board.

The principal duties and responsibilities of the nominatingNominating and governance committeeCorporate Governance Committee are as follows:

| • | |

| • | |

| • | take leadership role in overseeing management’s handling of ESG matters of importance to the Company; |

| • | develop and recommend to the Board a set of Corporate Governance Guidelines; and |

| • |

Each director who serves on the Nominating and Corporate Governance Committee is independent under the listing standards of the NYSE.Nasdaq rules. The Nominating and Corporate Governance Committee operates under a written charter adopted by the Board of Directors, a copy of which is available at the investor relations section of our website at https://investors.amneal.com/corporate-governance/policies.

Pursuant to the Stockholders Agreement, the Amneal Group has the right to nominate two of the four directors serving on the Nominating and Corporate Governance Committee for so long as the Amneal Group beneficially owns more than 50% of the outstanding shares of the Company. The remaining directors are designated by a majority of the Company Independent Directors of the Company’s Board.

Integration Committee

The principal duties and responsibilities of the Integration Committee are to oversee and serve as an advisory committee to the Company’s management in connection with the integration of the respective businesses and operations of Amneal and Impax following the Combination.

The Integration Committee operates under a written charter adopted by the Board of Directors, a copy of which is available at the investor relations section of our website https://investors.amneal.com/corporate-governance/policies.

Pursuant to the Stockholders Agreement, for a minimum of two years following the completion of the Combination, the Integration Committee will serve as an advisory committee to management in connection with the integration of Impax and Amneal.

The principal duties and responsibilities of the Conflicts Committee are to provide leadership and guidance to the Board and the Company regarding transactions or situations involving potential conflicts of interest between the Company and its related parties. The responsibilities of the Conflicts Committee include approval of certain transfers of shares of the Company by an Amneal Group member to third parties, approval of qualifying related party transactions, and approval of any material amendment to the Stockholders Agreement, as set forth in the Conflicts Committee Charter.

The Conflicts Committee operates under a written charter adopted by the Board of Directors, a copy of which is available at the investor relations section of our website https://investors.amneal.com/investors. amneal.com/corporate-governance/policies.

Pursuant to the Stockholders Agreement, until the Trigger Date, the Board will have a Conflicts Committee comprised solely of Company Independent Directors. Any amendments to the Conflicts Committee Charter will be approved by (i) 75% of the directors of the Company’s Board, (ii) a majority of the Company Independent Directors, and (iii) a majority of the Conflicts Committee. The responsibilities of the Conflicts Committee include approval of certain transfers of shares of the Company by an Amneal Group member to third parties, approval of any related party transactions, and approval of any material amendment to the Stockholders Agreement, as set forth in the Conflicts Committee Charter.

| AMNEALPHARMACEUTICALS, INC. | | |||

Management is responsible for managing the day-to-day risks our Company faces. Our Board of Directors is responsible for:

| • | confirming that management has implemented an appropriate system to manage these risks, i.e., to identify, assess, mitigate, monitor and communicate about these risks; and |

| • | providing effective risk oversight through the Board’s committee structure and oversight processes. |

Beyond these fundamental responsibilities for risk oversight, our Board concentrates on the broader implications of our strategic plans and allows the committees to focus on specific areas of risk. Our directors, through their risk oversight role, are responsible for confirming that the risk management processes designed and implemented by the Company’s executive officers and other senior managers are consistent with the Company’s corporate strategy and are functioning as directed.intended.

The Board believes that full and open communication between management and the Board of Directors is essential for effective risk management and oversight. Our executive officers attend our quarterly Board meetings. In addition to making quarterly presentations at suchour quarterly Board meetings, regarding our operations, our executive officers are available to discuss any questions or concerns raised by the Board relating to risk management and any other matters. In addition, management typically reports on cybersecurity matters to our Audit Committee twice a year.

While the Board is ultimately responsible for risk oversight at our Company, our Board committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk.

In accordance with its charter, the Audit Committee is required to, among other things, focus on the reasonableness of control processes for identifying and managing key business, financial and regulatory reporting risks. The Audit Committee is also mandated by its charter to discuss with management our Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures, including as required by the NYSE, our risk assessment and risk management policies. The Audit Committee monitors our Company’s credit risk, liquidity risk, regulatory risk, operational risk and enterprise risk bythrough regular reviews with management, external auditors and our Company’s internal audit function. The Audit Committee reviews and discusses with management the implementation, execution and performance of the Company’s enterprise risk management program and the strategies, processes and controls pertaining to the management of the company’s information technology operations, including cyber risks and information security.

The Compensation Committee assists the Board in fulfilling its oversight responsibilities with respect to the evaluation and management of risks arising from our compensation policies and programs. As a resultThe Compensation Committee has reviewed our incentive compensation programs, discussed the concept of risk as it relates to our compensation program, considered various mitigating factors and reviewed these items with its evaluation,independent consultant, Meridian Compensation Partners, LLC (“Meridian”).

In addition, our Compensation Committee asked Meridian to conduct an independent risk assessment of our executive compensation program. Based on these reviews and discussions, the Compensation Committee has concluded that the risks arising fromdoes not believe our compensation policies and practicesprogram creates risks that are not reasonably likely to have a material adverse effect on our Company.business.

The Nominating and Corporate Governance Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with corporate governance, including Board structure, size, membership and succession planning for our directors, as well as ESG matters of importance to the Company. The Committee also assists in carrying out the Company’s commitment to ESG principles and executive officers.diverse representation on its Board.

Integration Committee

The Integration Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of risks associated with the integration of Amneal and Impax.

The Conflicts Committee assists the Board in fulfilling its oversight responsibilities with respect to the management of the risks associated with the conflicts of interest that may arise from certain related party transactions.

While the Board is ultimately responsible for risk oversight, committees of the Board assist in fulfilling the oversight responsibilities of the Board in certain areas of risk. Our Audit Committee is responsible for overseeing risks from cybersecurity threats and receives cybersecurity updates from Information Technology (“IT”) leadership at least twice a year. When meeting with the Audit Committee, the IT leadership team highlights significant accomplishments and issues related to our IT infrastructure, including cybersecurity incidents, risks, industry trends, notable incidents facing other companies, incident preparedness and other developments. The Audit Committee also receives updates regarding progress on initiatives to further align with the five pillars of the NIST CSF. These briefings are designed to provide visibility to the Audit Committee about the identification, assessment, and management of critical risks, audit findings, and management’s risk mitigation strategies. Our global head of Cybersecurity, who reports to our CFO, participates in H-ISAC (Health Information Sharing and Analysis Center), a global community and member forum for coordinating, collaborating and sharing vital Physical and Cyber Threat Intelligence and best practices with each other. Our Board also receives regular quarterly updates from our Vice President of Corporate Compliance who reports to our Chief Legal Officer.

We administer multiple cybersecurity related training and awareness events annually. Our user awareness training program includes baseline cybersecurity training for all new employees and an annual mandatory interactive cybersecurity training

| www.amneal.com | AMNEALPHARMACEUTICALS, INC. | | |||

for all employees and contingent workers, as well as multiple cybersecurity topic awareness broadcast emails and targeted training to specific user groups. We employ a third party to conduct periodic penetration testing to scan different parts of the Company’s IT environment to identify potential vulnerabilities. Critical or high vulnerabilities are prioritized for swift remediation. Additionally, we employ a third-party service for continuous cyber risk monitoring and make continuous adjustments to system and network configurations to improve our cyber risk rating score. For further information related to our cybersecurity risk management process and identified cybersecurity risks, please refer to Part I, Item 1C of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

The Nominating and Corporate Governance Committee considers recommendations for directorships submitted by our stockholders.stockholders on a substantially similar basis as it considers other nominees. Stockholders who wish the Nominating and Corporate Governance Committee to consider their recommendations for nominees for the position of director should submit their recommendations, in accordance with the procedures (including the information requirements) set forth in our Bylaws, in writing to: Corporate Secretary, Amneal Pharmaceuticals, Inc., 400 Crossing Boulevard, Bridgewater, NJ 08807. In order forFor the Nominating and Corporate Governance Committee to have adequate time to consider such candidate, for inclusion on the director nominee slate, the stockholder’s notice should be received at the address above within the time period set forth in our Bylaws (see “Stockholder“Director Nominations and Other Proposals for Inclusion into Be Presented at Our 20202025 Annual Meeting Proxy Statement and Proxy Card”Meeting” below).

In its assessment of each potential candidate, the Nominating and Corporate Governance Committee reviews the nominee’s personal and professional integrity, ethics and values and ability to make mature business decisions. The Nominating and Corporate Governance Committee may also consider the following criteria, as well as any other factor the committee deems relevant:

| • | the candidate’s experience in corporate management, such as serving as an officer of a publicly held company; |

| • | the candidate’s experience as a board member of a publicly held company; |

| • | the candidate’s professional and academic experience relevant to our industry; |

| • | the strength of the candidate’s leadership skills; |

| • | the candidate’s experience in finance and accounting and executive compensation practices; |

| • | diversity of viewpoints, background, experience and other demographics; and |

| • | whether the candidate has the time required for the preparation, participation and attendance at board and committee meetings. |

Nominees may also be recommended by directors, members of management, or, in some cases, by a third partythird-party firm. In identifying and considering candidates for nomination to the Board, the Nominating and Corporate Governance Committee may consider, in addition to the requirements described above and set out in its charter, quality of experience, our needs and the range of knowledge, experience and diversity represented on the Board. Each director candidate is evaluated by the Nominating and Corporate Governance Committee based on the same criteria and in the same manner, regardless of whether the candidate was recommended by a stockholder or by others.

The Board of Directors does not have a formal policy on Board diversity as it relates to the selection of nominees for the Board. TheThat said, the Board believes that diversity and a variety of experiences and viewpoints should be represented on the Board. In selecting a director nominee, the Nominating and Corporate Governance Committee focuses on skills, viewpoints, expertise or background that would complement the existing Board. The Nominating and Corporate Governance Committee regularly assesses the composition of the Board and seeks to identify candidates representing diverse experience at policy-making levels in business, management, marketing, finance, human resources, communications and other areas that are relevant to our activities. In addition, one of the many factors that the Board and the Nominating and Corporate Governance Committee carefully considers is the importance to the Company of ethnic and gender diversity. The Nominating and Corporate Governance Committee assesses its effectiveness in this regard when evaluating the composition of the Board.

In the case of a recommendation submitted by a stockholder, after full consideration, the stockholder proponent will be notified of the decision of the nominatingNominating and governance committee.Corporate Governance Committee.

The Nominating and Corporate Governance Committee conducts the appropriate and necessary inquiries with respect to the backgrounds and qualifications of all director nominees. Diversity is essential to Amneal’s success. It starts at the top, with six out of ten of our executives identifying as diverse by race, ethnicity, or gender, and permeates through the organization of Amneal employees. In 2023, women represented 19% of our global workforce of Amneal employees. In the United States, they represented 41% of our workforce and held 32% of leadership roles at the level of Director and above for Amneal employees. Approximately 74% of our U.S. workforce of Amneal employees identified as diverse by race or ethnicity. The Nominating and Corporate Governance Committee also reviews the independence of each candidate and other qualifications of all director candidates, as well as considers questions of possible conflicts of interest between director nominees and our Company. After the Nominating and Corporate Governance Committee has completed its review of a nominee’s qualifications and conducted the appropriate inquiries, the Nominating and Corporate Governance Committee makes a determination whether to recommend the nominee for approval by the Board of Directors. If the Nominating and Corporate Governance Committee decides to recommend the director nominee for nomination by the Board of Directors and such recommendation is accepted by the Board, the form of our proxy solicitation will include the name of the director nominee.

| AMNEALPHARMACEUTICALS, INC. | | |||

The Company also places a high priority on creating a Board that reflects expanded experiences and perspectives, including experiences and perspectives arising out of diversity related to race, ethnicity, gender, sexual orientation and areas of expertise. Consistent with this philosophy, our Board reflects a mix of ethnic, sexual orientation and gender diversity. As set forth in the matrix below, of our 11 Board members, ten have disclosed their gender and demographic backgrounds, which consists of eight male and two female Board members, with three Board members who identify as Asian, seven who identify as white and one who identifies as LGBTQ+.

| Board Diversity Matrix (As of March 11, 2024) | ||||||||

| Board Size: | ||||||||

| Total Number of Directors: | 11 | |||||||

| Female | Male | Non-Binary | Did not Disclose Gender | |||||

| Gender: | ||||||||

| Directors: | 2 | 8 | 1 | |||||

| Number of Directors who Identify in Any of the Categories Below: | ||||||||

| Asian | 3 | |||||||

| White | 2 | 5 | ||||||

| LGBTQ+ | 1 | |||||||

Each of our non-employee directors receives an annual fee payable in cash. In addition, so that our non-employee directors have an ownership interest aligned with our stockholders, each non-employee director also receives an annual grant of stock options and restricted stock units. Board members also receive an initial equity grant when they join the Board. Members of our Board committees receive an additional annual fee for each committee on which they serve, other thanserve. In addition to the Integration Committee. Ourannual grant of restricted stock units that all non-employee directors are entitledeligible to reimbursementreceive, our Chairman receives an additional annual award of their reasonable out-of-pocket expensesrestricted stock units with a grant date fair value of $100,000 in connection with their travelhis increased duties. From time to and attendance at Board and committee meetings. Thetime, the Compensation Committee reviews the compensation of our non-employee directors was reviewed bywith our independent compensation consultant and makes recommendations to the Board with respect to any changes; our non-employee director compensation program was last reviewed in May 2018.2023. In connection with this update, and as recommended by the independent compensation consultant based on market practices, no changes were made to the non-employee director compensation. No changes were made to our non-employee director compensation structure during 2023 other than the use of a 12-month average stock price over 2022 in setting the grant price for all equity awards to directors. This 2022 12-month average stock price was $3.27, as compared to an actual date of grant closing price of $1.86. Consequently, grant date fair values for awards to non-employee directors were only 57% of targeted values. The Company expects to revert back to its historic methodology of using the closing market price of our common stock on the date of grant for setting the grant price with respect to future equity grants to non-employee directors. This change in setting the grant price was made in order to align with grant price methodology used for awards made to NEOs and eligible employees.

Our director compensation program is summarized in the table below.

| Annual | ||

| $75,000 | ||

| $ | ||

| 250,000/$ | ||

| Vesting Schedule | 1 year cliff vesting | |

| Additional Cash Fees for Committee Service | ||

| Audit Committee (Chair/Member) | $25,000/$15,000 | |

| Compensation Committee (Chair/Member) | $20,000/$10,000 | |

| $15,000/$7,500 | ||

| Conflicts Committee (Chair/Member) | $ |

In addition to the annual retainers described above, for each duly convened meeting of a committee that a member of such committee attends in excess of six duly convened meetings per calendar year, such member shall be entitled to receive an additional Per Meeting Stipend equal to 1/6th of such member’s annual cash stipend for service on that committee.

| www.amneal.com | AMNEAL PHARMACEUTICALS, INC. | 2024Proxy Statement | 18 | ||

During fiscal 2018,2023, our non-employee directors received the following compensation:

| Name | Fees Earned or Paid in Cash(1) | RSU Awards | Option Awards | Total | ||||||||||||

| Emily Peterson Alva | $ | 60,000 | $ | 91,667 | $ | 183,333 | $ | 335,000 | ||||||||

| J. Kevin Buchi | $ | 70,000 | $ | 91,667 | $ | 183,333 | $ | 345,000 | ||||||||

| Robert L. Burr | $ | 95,000 | $ | 91,667 | $ | 183,333 | $ | 370,000 | ||||||||

| Jean Selden Greene | $ | 55,000 | $ | 91,667 | $ | 183,333 | $ | 330,000 | ||||||||

| Ted Nark | $ | 63,333 | $ | 91,667 | $ | 183,333 | $ | 338,333 | ||||||||

| Chintu Patel | $ | 50,000 | $ | 91,667 | $ | 183,333 | $ | 325,000 | ||||||||

| Chirag Patel | $ | 50,000 | $ | 91,667 | $ | 183,333 | $ | 325,000 | ||||||||

| Gautam Patel | $ | 56,667 | $ | 91,667 | $ | 183,333 | $ | 331,667 | ||||||||

| Dharmendra Rama | $ | 55,000 | $ | 91,667 | $ | 183,333 | $ | 330,000 | ||||||||

| Peter R. Terreri | $ | 71,667 | $ | 91,667 | $ | 183,333 | $ | 346,667 | ||||||||